Have you ever felt awkward asking clients to make payments after sending them multiple reminders? You are not alone.

Many business owners have admitted to feeling uncomfortable when having to chase clients for payments due.

This can be even more challenging to do so while trying to maintain a professional tone when you have to request immediate payments without having to add any late charges.

However late payments from customers are an all too common problem for many businesses and is a significant cause of cash flow issues. Many entrepreneurs report waiting over 30 days for payments which creates a domino effect, making it difficult to pay vendors, suppliers and even staff.

To alleviate these challenges, we have compiled a list of helpful tips aimed at encouraging clients to pay their bills on or before the due date.

1. Set clear payment terms in advance

Prepare a written agreement between you and your client that outlines payment terms, deadlines and fees. This helps clients understand your payment policy and when invoices will be sent.

Payment terms can be highlighted on each invoice such as “due upon receipt” or “net 30”

2. Ask for upfront payments or deposits

Although typically reserved for large projects, asking for a 50% upfront payment shows good faith and allows for the remaining balance to be paid upon completion.

3. Offer flexible payment options

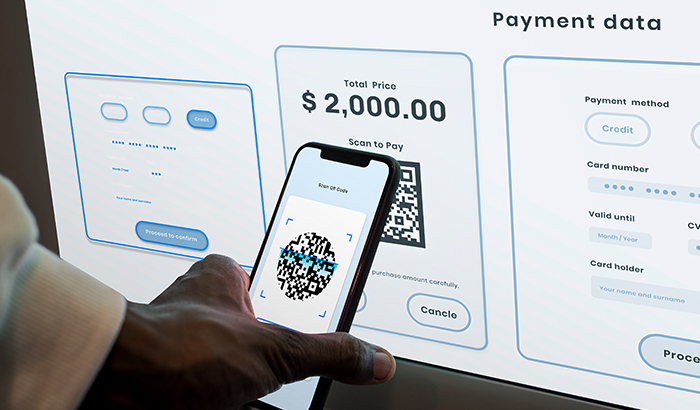

Providing various payment methods incentivizes clients to pay promptly. Consider accepting a minimum of three options, such as cheques, credit cards, direct wire transfers, or online payments

4. Automate invoices

When you send invoices by mail, it can take too long and you often run the risk of the invoice getting lost and it adds to the expense of billing clients.

To improve efficiency and ensure timely payments, consider automating the process with smart invoice systems or accounting software. As your business expands, this functionality will safeguard your profits, enhance cash flow, and minimise the risk of missed payments or stale invoices.

5. Offer a retainer

Offering a retainer for long-term work can provide clients with clear expectations regarding payment amounts and deadlines. This allows for more effective budget management and can even lead to faster payments. Customers also have the added value of budgeting more effectively.

6. Invoice promptly

Sending your client the invoice promptly links the completed work and payment together and ensures you’re taking all the necessary steps to reduce your waiting time.

7. Follow a payment schedule

If the client expects an invoice from you on the 1st and 15th of each month, then you need to deliver your bills on those dates.

Adhering to a set payment schedule ensures clients receive invoices when expected and can minimise confusion and maximises your chances of getting paid on time.

8. Review invoices weekly

While it’s easy to get distracted by daily tasks and project work, part of the responsibility in collecting invoice payments is up to you.

Keep track of invoices and review your accounts receivable on a weekly basis to identity clients who have not yet paid.

9. Send payment reminders regularly

Be proactive before payment is due, will help you ensure your client is aware of upcoming due dates.

Send friendly professional reminders can serve as a helpful tool in promoting clients to remember the deadline is approaching.

10. Offer early payment discount

Reward those who choose to pay early with a small incentive or discount – even a 2% discount can provide clients with a cost advantage and motivate them to settle their invoices promptly. This could potentially accumulate into savings over time.

11. Don’t waver on payment terms

It is unfortunate that sometimes we interpret flexibility as an excuse for continually being late with payments. While this can happen once in a while, you should remind clients that payment terms have not changed and remain in effect.

12. Promptly follow up on payments

Once you’re completed the work, it’s up to you to make sure you get paid.

Implement a standard approach to follow up on outstanding payments and make this process less stressful.

If you haven’t received payment after your initial reminder, consider a polite call to confirm your client has received the invoice and see if they have any questions.

13. Penalise late payment

Another way to encourage early payments is to introduce a late payment fee – a small 2% for nonpayment can have a large enough impact on your client’s bottom line to motivate a speedy turnaround.

Keep in mind that not every approach will work effetely for all client so try different tactics to see which one produces the best results.

And remember, the best way to get paid is to protect your business by signing a contract and creating a professional invoice that outlines all terms of the job.

Contact us if for a consultation with our accounting experts [email protected]