Is your Business Corporate Tax Ready?

achieve corporate tax readiness with expert guidance and strategic planning. stay compliant, minimize risks, and focus on your core business activities with confidence_

Are you eligible to pay Corporate Tax? _

According to the FTA, All Companies and now Natural Persons fall into the scope of Corporate Tax if they meet the required conditions. Our team has put together a short tax decision matrix to help you determine whether you are eligible to register & pay Corporate Tax.

Complete our Tax Assessment to find out if you meet the required conditions for Corporate Tax.

UAE corporate tax_

Prepare early for the implementation of Corporate Tax in the UAE on June 1, 2023. Avoid costly mistakes and ensure a smooth transition by addressing compliance obligations like tax returns, pricing documents, and document retention.

AT CRESCO Accounting we assist companies register for Corporate Tax, submit Tax Filings, apply for Tax Relief and make sure they comply with all requirements to avoid penalties.

How to prepare for UAE corporate tax?_

With the introduction of Corporate Tax in the UAE on 1 June 2023, there will be significant compliance obligations on companies in the form of tax returns, pricing documents and document retention.

It is important to start preparing for this change as early as possible to make the transition smoothly and avoid any costly mistakes.

VAT in UAE_

VAT implementation has transformed the business landscape in the UAE, introducing a complex set of regulations and compliance requirements.

Our team of experienced VAT professionals understand the intricacies of the UAE’s VAT Framework.

VAT

CONSULTATION_

We help you determine whether you require mandatory or voluntary VAT registration and what the implication of VAT will be on your business operations.

VAT

REGISTRATION_

Following our thorough consultation, we will assist you in the registration process to obtain a Tax Registration Number (TRN) certificate.

VAT

FILING_

We handle the preparation and filing of VAT returns, maintain accurate records and ensure you meet and comply with the FTA’s requirements.

Book a consultation_

FAQ's_

Book an appointment with a tax professional to understand the CT requirements for your business activity:

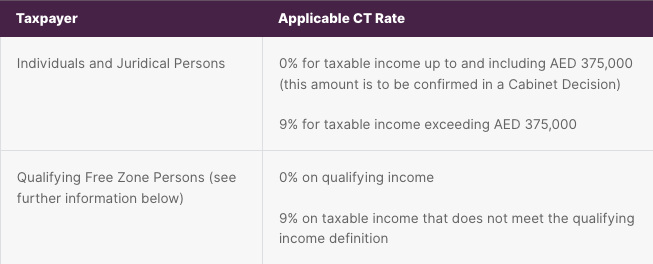

- Identify if your business is legible for Corporate Tax (earns taxable income that exceeds 375 000 AED per annum)

- Identify the tax period for your business

- Identify by when your business would need to file a UAE CT return

- Determine how CT may impact your business obligations & liabilities under contracts with customers and suppliers

- Guide you on the financial information and records your business will need to provide for UAE CT purposes

- Prepare for CT Filling

Taxpayers are required to register before they file their first CT return.

Only one CT return will need to be filed per Tax Period. The CT return will generally be due within 9 months following the end of the Tax Period. No provisional or advance UAE CT filings will be required.

Taxpayers should prepare their financial statements, and determine their taxable income on an accrual’s basis, unless they are permitted to use the cash basis of accounting instead. The Minister may prescribe the instances where a taxpayer can prepare financial statements using the cash basis, which is expected to be available for certain categories of individual entrepreneurs and small businesses.

Business set up, licence renewal and other Government fees and charges incurred wholly and exclusively in the ordinary course of business are deductible for CT purposes.

UAE holding companies would be subject to UAE CT (at a 9% CT rate or the 0% Free Zone CT rate), depending on whether the holding company is established in a Free Zone or in the mainland UAE, but dividends and capital gains earned from domestic and foreign shareholdings would generally be exempt from CT, subject to certain conditions.

Why businesses love us_

...it saved us huge amount of time organising business accounts with invoices and VAT processing and filing. We have been working with Cresco accounting since 2017 and I must say that it saved us huge amount of time organising business accounts with invoices and VAT processing and filing. Charmaine and Eiza did us efficient service and very helpful with all our enquiries. I am happy to see continued improvements on their services and highly recommended to all my contacts.

We are fortunate to have chosen CRESCO, a responsive, flexible and customer friendly firm. We have worked with CRESCO since VAT was implemented in the UAE. At all times they are professional, organized and totally unflappable; whatever we asked them to do. They also keep us focused by regularly feeding back to us progress to date. Charmaine and her great team work together to provide ExpertiseGlobal with sound professional services. I would recommend CRESCO to anyone who is looking for an accounting company to handle their tax issues and shall certainly be engaging with them again in the future.

The quality and sophistication of results are beyond what we could have expected. Maricar and the team at CRESCO Accounting have been instrumental in helping us in the VAT implementation and QuickBooks accounting processes. The specialist team continues to provide valuable support throughout. No matter what the question is, they always have the right answers. The quality and sophistication of results is beyond what we could have expected. We highly recommend their services!