Is Your Business ready for the first Tax Year – Part 2

Following the positive response to our recent insights on how businesses can prepare for Corporate Tax, we’re excited to present Part 2. This article delves into crucial topics your business must address to ensure thorough readiness for the upcoming Tax implementation. From comprehending its implications on legal, financial, and operational facets to aligning your people, […]

Is Your Business ready for the first Tax Year – Part 1

For many businesses in the UAE , Corporate Tax will kick in on 1st January 2024. As such there are many topics that businesses need to consider to be adequately prepared for the Tax implementation. These range from understanding how it impacts your legal, financial and operation aspects , to how your people, processes and […]

The Ultimate Guide to Securing a Business Loan in UAE

Have you recently registered your business in Dubai and are now seeking capital to fuel your growth ambitions? Dubai’s vibrant business landscape offers ample opportunities for SMEs to strategically plan for the long term and secure their cash flow. According to reports from WAM, Emirate banks have provided an impressive AED 93.4 billion to support […]

Navigating Corporate Tax Incentives for Qualifying Free Zone Entities in the UAE

In today’s dynamic economy, understanding corporate taxation is crucial for businesses seeking strategic benefits. The UAE’s recent Ministerial Decision No. 139 of 2023 is a significant development that defines criteria and rules for Qualifying Free Zone Persons under the Corporate Income Tax Law. This decision introduces a framework for identifying these persons, setting conditions, and […]

Secrets of successful start ups – what you should know!

In the world of entrepreneurship, making mistakes is an inherent aspect of launching a business venture. It’s a journey filled with trial and error, where initial missteps become stepping stones towards eventual success. In the beginning you may fail over and over again, but the faster you can navigate through these failures and gather data […]

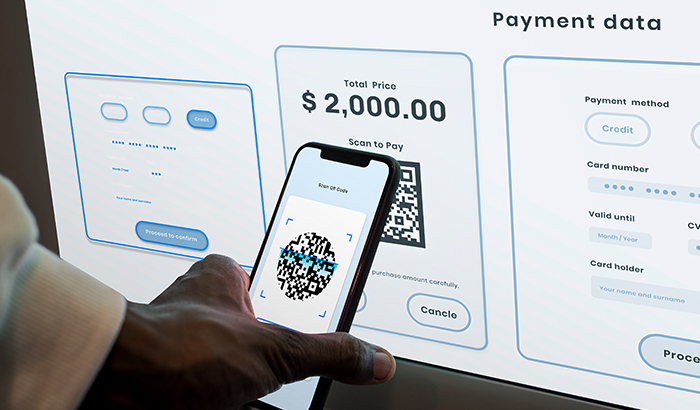

Tips to get clients to Pay their bills faster!

Have you ever felt awkward asking clients to make payments after sending them multiple reminders? You are not alone. Many business owners have admitted to feeling uncomfortable when having to chase clients for payments due. This can be even more challenging to do so while trying to maintain a professional tone when you have to […]

New E-commerce VAT Reporting Rules for UAE businesses

As of 1 July 2023, Emirate-Level VAT Reporting will be implemented for resident taxpayers and will require them to report taxable supplies made through e-commerce in the emirate in which the supply is received if it exceeds 100 million UAE Dirhams ($27 million dollars). This new reporting requirement should result in a more suitable […]

How Middle Eastern CEOs are future-proofing their companies.

According to a report published by PWC, Middle East CEO’s are optimistic about the region’s economic growth prospects, with two thirds of business leaders expecting improvements this year despite global challenges. We have pulled together key takeaways on how CEO’s in the region plan to future proof their organisations. Digitalisation & global talent Investment Technology, […]

Become more competitive by establishing a cash culture

Where your cash is going determines where your business is heading. Prior to COVID-19, a cash culture was not a priority – businesses were looking at growth, top line, profitability and the PNL: instead of focusing on liquidity matters which (if ignored) can become drivers for business failure. Many large organisations including the government perceive […]

UAE Corporate Tax: Impact on contracts, permanent establishments and more

With the introduction of Corporate Tax in the UAE on 1 June 2023, there will be significant compliance obligations on companies in the form of tax returns, pricing documents and document retention. In this article, we unpack some of the areas to be considered from an accounting perspective. Impact on Contracts Given the potentially adverse […]